The designers behind UOB’s first mobile-only bank

Singapore’s United Overseas Bank (UOB) launched its first mobile-only bank, TMRW, in Thailand in March 2019 – testament to how design is playing a pivotal role in the bank’s digital banking business.

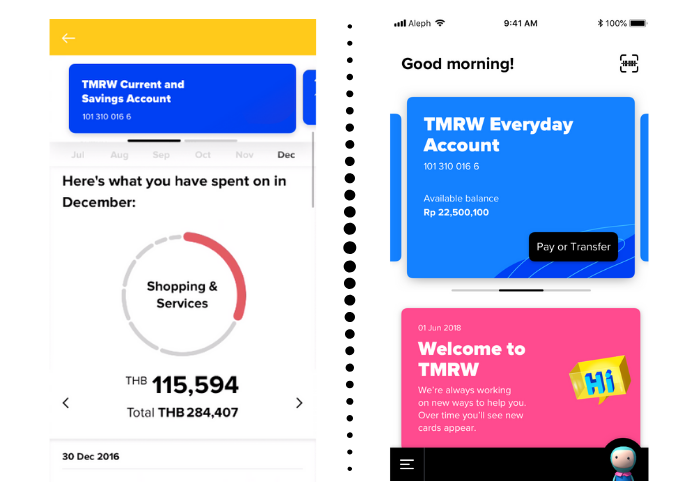

TMRW allows you to do your banking without ever having to step into a physical branch. It has been designed to be intuitive – there is no traditional app menu, for instance. Instead, using AI, the digital bank will learn from each customer’s usage journey and from there, present the most relevant and customised functions and information for him or her.

“Employing design thinking and research serve to challenge assumptions and bridge those gaps.”

Stuart Smith, Executive Director, Head of Regional Engagement Platforms & User Experience Design at UOB

UOB is confident this new digital bank is what younger customers in the rapidly growing markets of South East Asia want – having invested time and effort to deeply understand this segment of their customers.

UOB’s Digital Bank team has grown in the last two years for this reason. Among the new hires in 2018 were designers for their regional Engagement Labs (eLabs), which employ AI, data analytics, User Experience (UX) and User Interaction (UI) design to provide customers with a smart, personalised banking service.

From the get-go, the UOB Digital Bank team adopted design thinking practices. It derived design principles from deep customer research, insight gathering, and ethnographic research around how people wanted to bank and live their financial life, how they used banking products and what they expected in terms of interaction with their financial service provider.

“We prefer to call it customer-centricity rather than just design thinking” says Stuart Smith, Executive Director, Head of Regional Engagement Platforms & User Experience Design at UOB.

He adds that a sad fact – across banks globally – is that many people are tasked with making decisions about products and services for people in different generations to them, brought up with a very different expectation of what these services should be in a digital era.

What’s Design Thinking?

Design thinking is a process that uses elements from the designer’s toolkit (like empathy and experimentation) to address complex challenges in a holistic and innovative manner. Its human-centred approach places end-users and their needs at the heart of things. A key feature is in-depth interviews to deeply understand users, so that design thinkers can create solutions that will truly answer needs.

“I, myself, am a British born man living in Singapore. In setting up a digital bank in Thailand, how much do I know about the lived experience of Thai youth? Not that much!” he admits with a chuckle. “So employing design thinking and research serve to challenge assumptions and bridge those gaps.”

With TMRW, the primary target is urban millennials. This digital generation makes up one-third of the population in Thailand. UOB’s Managing Director of TMRW Digital Bank, Dennis Khoo, recognises that millennials “work differently, play differently, and… are going to bank differently”.The game plan to reel in millennials

A 2017 survey they conducted in Indonesia, Thailand and Malaysia, found that millennials “respond better to prompts that are fun and do not make them guilty” when it comes to managing their personal finances.

This led the team to consider using games to encourage saving and smart spending.

The UOB team decided to push this idea through; an ex-game developer in the TMRW team along with the UX, Product and Marketing teams invented and designed a savings game.

Mashable describes it as “the more money users save, the faster they level up in the mobile-only digital bank app. As users level up, they would unlock various options to build and enhance their virtual city.”

What started out as an experiment has now become a striking unique and popular feature within the TMRW app, which has gained interest from around the world

Besides having a game developer in his team, Smith reveals that “we have many design teams and skills within UOB Digital Bank, operating with different scope and different structures.”

From UI specialists working on screen interaction to a service design team that looks at delivering consistently good customer service through the bank’s chatbot or customer contact centre.

“In the Digital Bank, user experience design is constantly a leadership level discussion and we have no need to ‘sell’ design as it were. All of our teams have design and customer-centricity KPIs and discussions and so design has become part of the everyday thinking.”

Designing for diversity

In developing a regional digital bank for ASEAN, the biggest mistake one can make, he states, is to assume that Southeast Asia is a homogeneous market and that designing for customers across the region can be one-size-fits-all.

The challenge is to design for customers across different languages and cultural nuances.

While one option is to create a variation of the TMRW app for every single country, the higher technical costs of doing this make it less attractive. So what UOB TMRW has done is to opt for a model that blends modular reusable code elements across the region whilst designing in capability within the app itself to adapt to local circumstances.

Enter: the newly-created TMRW “eLabs”.

The engagement labs, or eLabs, are operational teams based in each country equipped with a range of advanced tools and techniques to engage with customers of that specific country, around the things that matter to these customers.

“So, the net effect is we have the technical benefits of a scalable regional app platform but the eLab teams in Thailand, Indonesia or Vietnam are able to have real time and uniquely local conversations and engagement with customers in their market,” he explains.

“The process of designing this approach or system took us some time and involved a cross-disciplinary team drawing skills from technology, data science, behavioural economics and UX. I guess we would call this strategic or systemic design – we designed the TMRW organisation with a focussed intent and outcome in mind. In the course of this, we realised we needed a new type of team: the eLabs.”

Keeping it simple

Despite cultural nuances, studies across the region indicate young people seek one thing, especially in relation to finance: simplicity.

By deploying best practice UX and UI principles, as well as AI and data analytics, the design teams aim is to create uniquely personal user experience for the customer, which simplifies service, for them.

Ironically, simplicity (especially in regulated financial services) is deceptively difficult to design for, a fact that Smith acknowledges. The TMRW team leverages on advanced analytics and AI in a way in which UX teams often haven’t in the past, to learn from each customer’s usage patterns, anticipating the upfront functions and information that each customer needs.

To make this design process seamless, design and technology skills at close interplay with one another must be tightly blended together.

Smith discloses that “we have our designers and analysts working very closely to our UX people, who are sitting very close to our AI platform people. In essence, we are all working on the same job, which is to deliver an unbelievably good customer experience. Designing for or with machine intelligence, or computational design, as I’ve heard it referred to, is an emerging area and one of the best things about TMRW is that we are set up to innovate in these areas.”

The case for design

Like most digital products or services, TMRW is a “living” platform where the iterations never stop. To keep improving, many mechanisms for customer feedback have been built in, and the collected data and feedback loop back into the design process.

In this way, the Digital Bank will evolve with the needs of the millennials. Khoo notes that in 10 to 15 years, these millennials will be the bank’s core customers. Therefore, understanding them and their needs now will help to better serve them in the future.

At the end of the day, design is employed to create better experiences for customers; in UOB, that is fundamental. While it may seem that having an in-house design team and design thinking skills was perhaps seen as a luxury for a bank, Smith believes it is now essential. This is reflected in the investment seen across the financial sector in design skills.

“As competitive pressures force financial services organisations to focus even more closely on the customer experience – in particular the digital customer experience – adopting a design-led mindset with strong human-centred design principles as guiding rails is only common sense.”